Ifrs 16 depreciation calculation

Right-of-use asset Normally a lessee needs to measure the right-of-use asset using a cost model under IAS 16 Property Plant and EquipmentIt basically means to depreciate the asset over the lease term. Now in the contract amount for 2020-2025 is given but 2026-2045 is not given as it will depend on the market during that time.

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

There is some confusion related to the accounting for these payments and incorporating them to the lease accounting schedule thus in this post and video in the end I responded to questions that are frequently popping up.

. How to amend impairment models for right-of-use assets under IFRS 16. Operating lease in the lessees accounts under IFRS 16. Therefore the standard is now effective for all organizations following international.

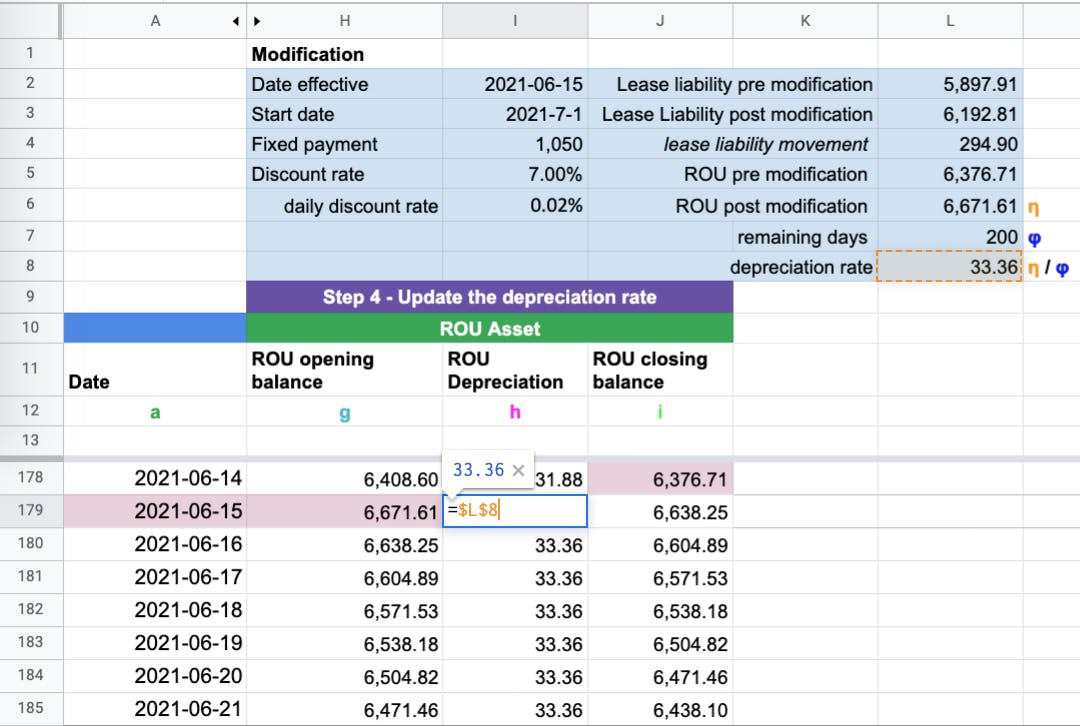

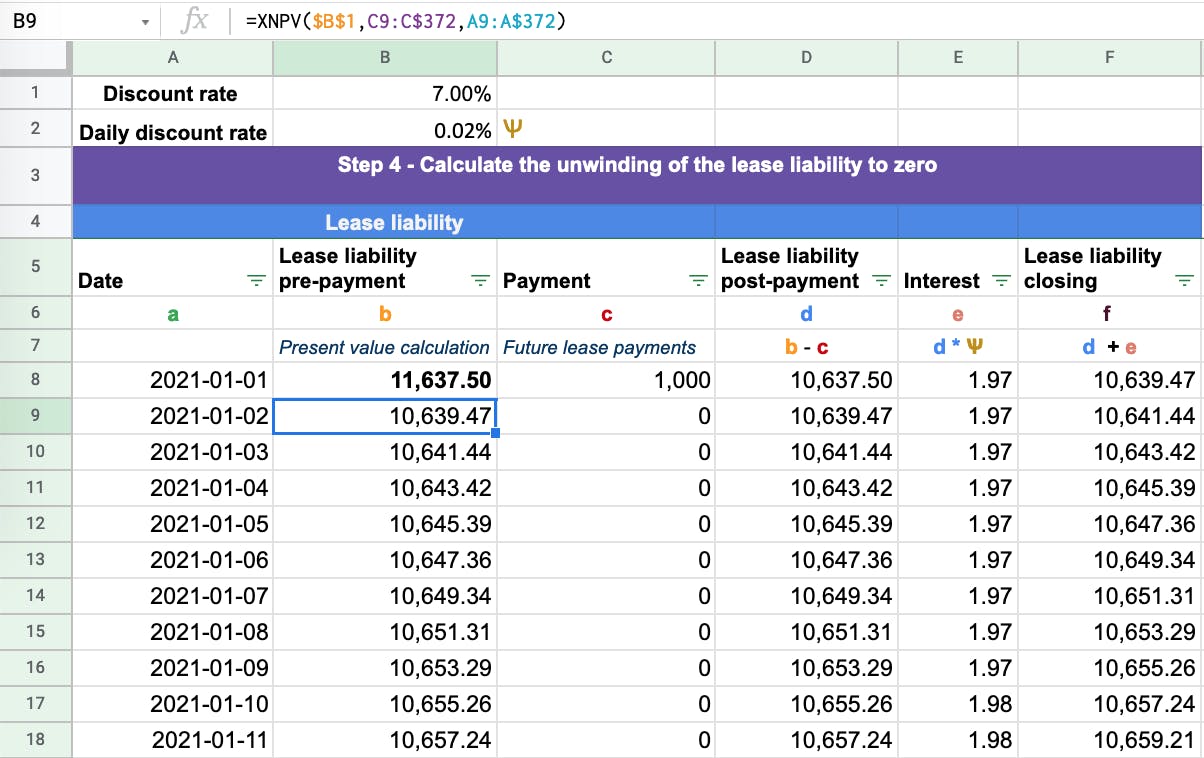

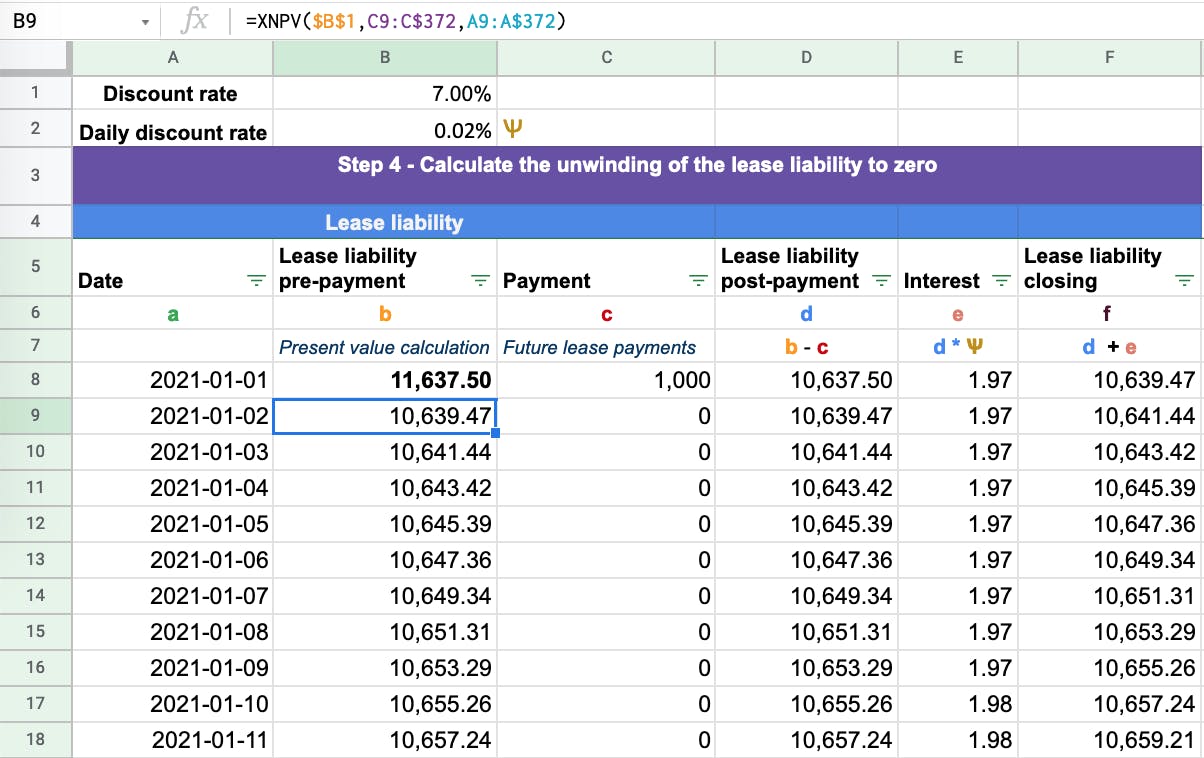

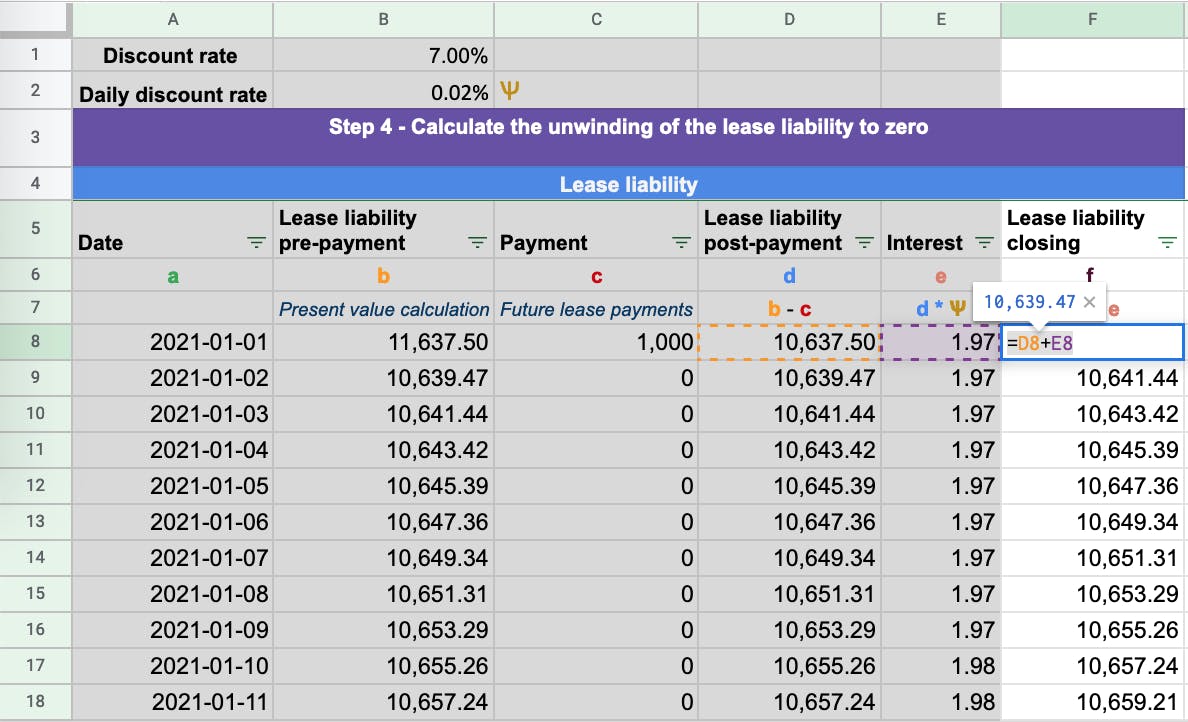

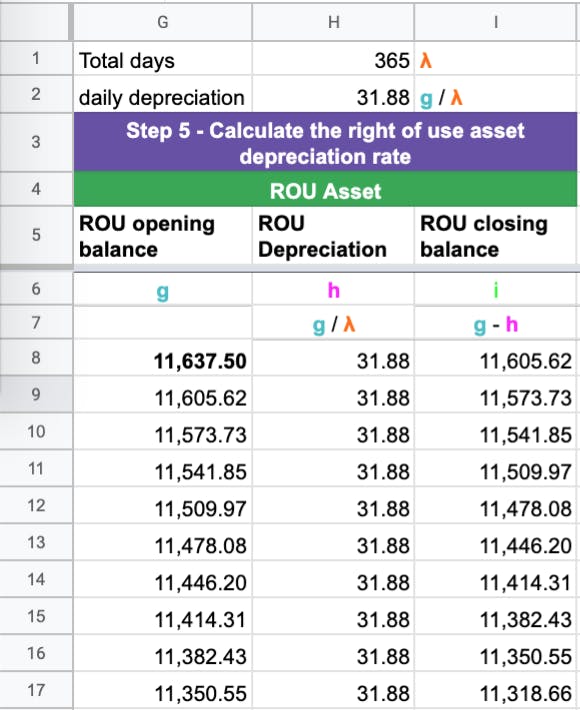

This can be an important practical consideration for lessees that lease big-ticket items under operating leases and adopt a component approach to maintenance accounting eg. The final step for our IFRS 16 journals is to calculate the depreciation on the Right of Use asset. The following amortization table shows the initial calculation of the lease liability using a payment of 20000 per year and an interest rate of 9.

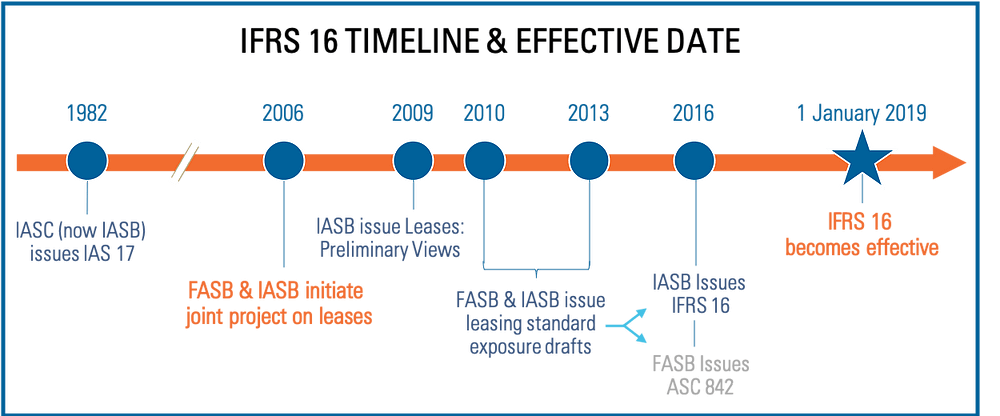

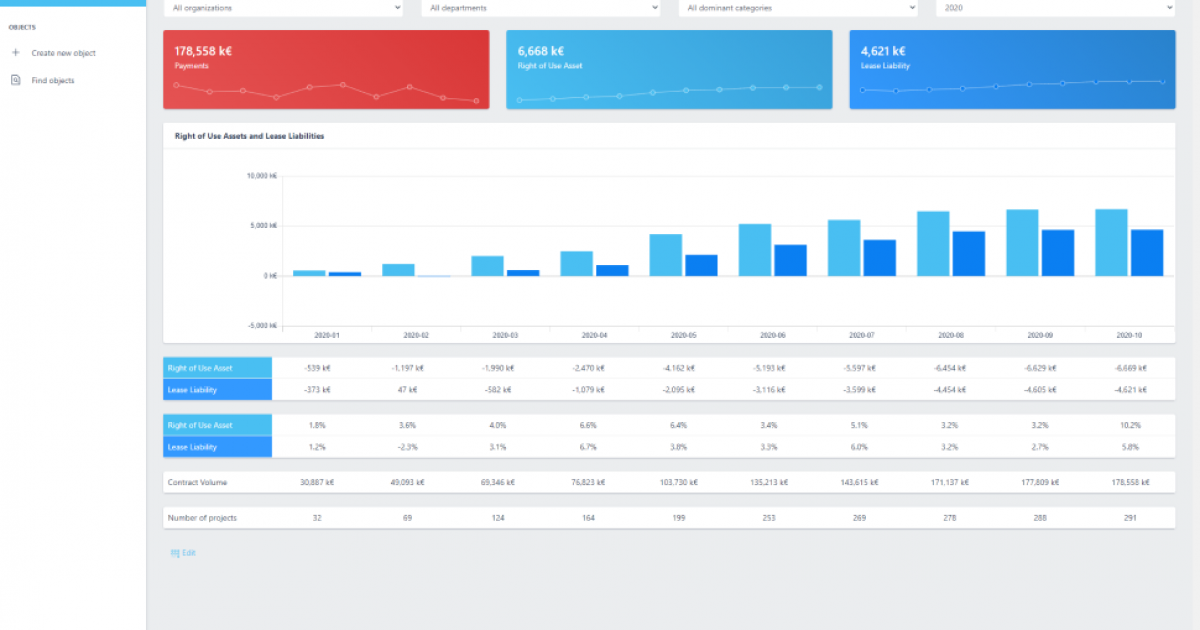

Lets work through a calculation example on initial measurement of a lease based on the following assumptions. The new leases standard IFRS 16 Leases applies to annual periods beginning on or after 1 January 2018 so would impact financial statements for years ending 31 December 2019 and 30 June 2020While many entities lessees in particular are still grappling with the mechanics of lease accounting. Scenario background 4 of 5 Scenario background.

Payments that depend on a rate. SAP RE-FX Valuation Rule customizing offers various interest calculation methods we can have simple to complex interest. IAS 16 excel examples.

Depreciation of CU 7 780 plus. If asset is owned at. If we wanted to get the monthly depreciation amount we simply divide by 36.

Expense for cleaning services of CU 1 429. You should not include the same risk twice into your calculation and therefore when your estimates are in current prices then you should a real discount rate excluding the effect of general inflation. IAS 21 excel examples.

This was exactly what I needed. IFRS 16 states that a lessee applies the depreciation requirements in IAS 16 and therefore identifies separate components for the purposes of depreciation. The scope of IAS 16 3 of 5 The scope of IAS 16.

Thank you so much. Under the new lease accounting standard IFRS 16 AASB 16 the net present value calculation is referred to as a lease liability and the leased asset is referred to as the right of use asset. The depreciation period of RoU should not exceed the lease term unless the lease contract transfers ownership of the underlying asset to the customer lessee by the.

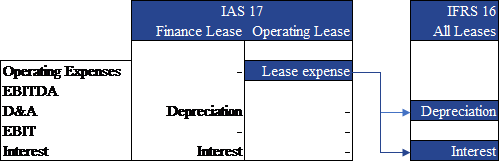

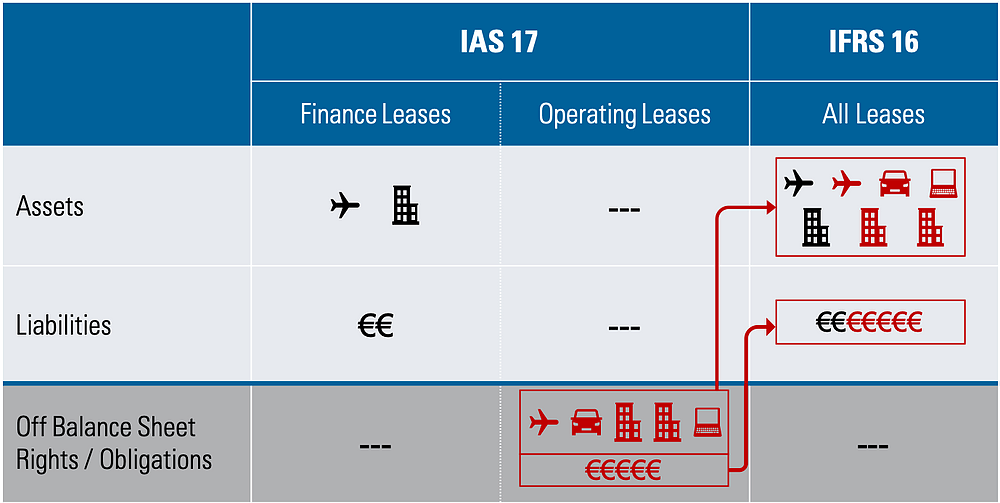

IFRS 16 Leases is a change from previous guidance due to its single-model approach for lessees whereby all lessee leases post-adoption are recognized as finance leases and capitalized. Depreciation tab will look like below for IFRS 16 leasing purpose a special depreciation key LEAX has been provided by SAP with base method depreciation settings as Depreciation from Real Estate Leasing. Unlike IAS 17 where the distinction between capital leases and operating leases requires only capital leases to be recognized on the balance sheet IFRS 16 provides greater.

This is perhaps the most simple calculation required for our IFRS 16 workings and is done by simply dividing the opening RoU asset by 3 to get the annual depreciation. Diminishing balance depreciation with residual value. IFRS 16 Variable lease payments IFRS 16 Variable lease payments IFRS 16 Variable lease payments.

The IFRS for Small and Medium-Sized Entities IFRS for SMEs is a set of international accounting requirements developed specifically for small and medium-sized entities SMEs. Comparison of Education Advancement Opportunities for Low-Income Rural vs. Exemption for initial recognition of leases under IFRS 16.

ABC the manufacturing company needs to adopt the new standard IFRS 16 Leases in the reporting period ending 31 December 2019. IFRS 16 Lessee accounting. Contract starts on 1 Jan 2020 and will end in 31 Dec 2045.

The following IFRS 16 presentation explain IFRS 16 calculation example. IFRS 16 summary. I have a quesstion I will be applying IFRS 16 on my rent for Jan 2020.

After commencement date lessee needs to take care about both elements recognized initially. IAS 19 excel examples. Sum of the digits depreciation.

The objective of IAS 16 2 of 5 The objective of IAS 16. The calculation 6 of 9 Depreciation. This article will cover two practical examples of how to calculate for a.

Companies previously following the lease accounting guidance under IAS 17 likely transitioned to IFRS 16 during their 2019 fiscal year in accordance with the standards effective date of January 1 2019 for annual reporting periods beginning on or after that date. Could you also explain the accounting of this decommissioning liability under IFRS 16 considering the various transition approaches IFRS. Interest of CU 1 167 plus.

In this months IFRS 16 article we look at how lessees should measure the right of use asset. During the preparatory works ABC discovered that the operating lease contract related to a machine might require some adjustments. Urban High School Student.

Under IAS 17 the impact on profit or loss in the year 1 was CU 10 000 as we recognized the full rental payment in profit or loss. Consistent with payments that depend on an index variable lease payments that depend on a rate are initially measured using the rate as at the commencement date of the lease IFRS 1627b IFRS 1639 IFRS 1642b. Variable lease payments are the payments that can change depending on something in the future for example inflation rate future sales asset use etc.

Accounting for lease By Lessee. Simple calculation of defined benefit plan. TOTAL of CU 10 376.

Under paragraph 29 of IFRS 16 the subsequent measurement of a right-of-use asset will be made up of accumulated depreciation less impairment losses. IAS 16 and IAS 38 require companies to review the estimated residual values and expected useful lives of assets at least annually and to reflect changessuch as those that might arise from climate-related mattersin the amount of depreciation or amortisation recognised in the current and subsequent periods. Account for any depreciation expense and accumulated impairment losses if any.

When determining the relevant time period to calculate depreciation an entity uses the lease term as determined in the initial recognition calculation unless the initial recognition contemplates purchase options being utilised or the lease. Under IFRS 16 the impact on profit or loss in the year 1 was. Recognition of exchange differences.

The FASB completed in February 2016 a revision of the lease accounting standard. It has been prepared on IFRS foundations but is a stand-alone product that is separate from the full set of International Financial Reporting Standards IFRSs. Accounting for leases in the United States is regulated by the Financial Accounting Standards Board FASB by the Financial Accounting Standards Number 13 now known as Accounting Standards Codification Topic 840 ASC 840These standards were effective as of January 1 1977.

Debit Profit or loss Depreciation charge. Enter the email address you signed up with and well email you a reset link. Diminishing balance depreciation without residual value.

Ifrs 16 Cortell Intelligent Business Solutions

Ifrs 16 Leasing Wikibanks

Lease Accounting Ifrs 16 Excel Template 365 Financial Analyst

An Overview Of Ifrs 16

Ifrs 16 Leases Summary Example Entries And Disclosures

The Simple Guide To Ifrs 16 What You Need To Know

Fp A Lease Accounting Software For Ifrs 16 Unit4

The Ultimate Guide To Accounting Under The Ifrs 16 Standard Occupier

Ifrs 16 Leases The Impact On Business Valuations Accountancy Age

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Ifrs 16 Leases Calculation Template

An Overview Of Ifrs 16

The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Simple Income Statement Template Beautiful The Four Basic Financial Statements An Overview Statement Template Income Statement Financial Statement

Example Lease Accounting Under Ifrs 16 Youtube

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16